Many people have no choice but to borrow the money to pay for their higher education expenses, but it has caused serious financial consequences for many who do. Consider the following three statistics relating to delinquency in student loans:

- Student Loan Delinquency or Default Rate: 11.2%2

- New Delinquent Balances (30+ days): $32.6 billion2

- New Delinquent Balances-- seriously delinquent (90+ days): $31 billion2

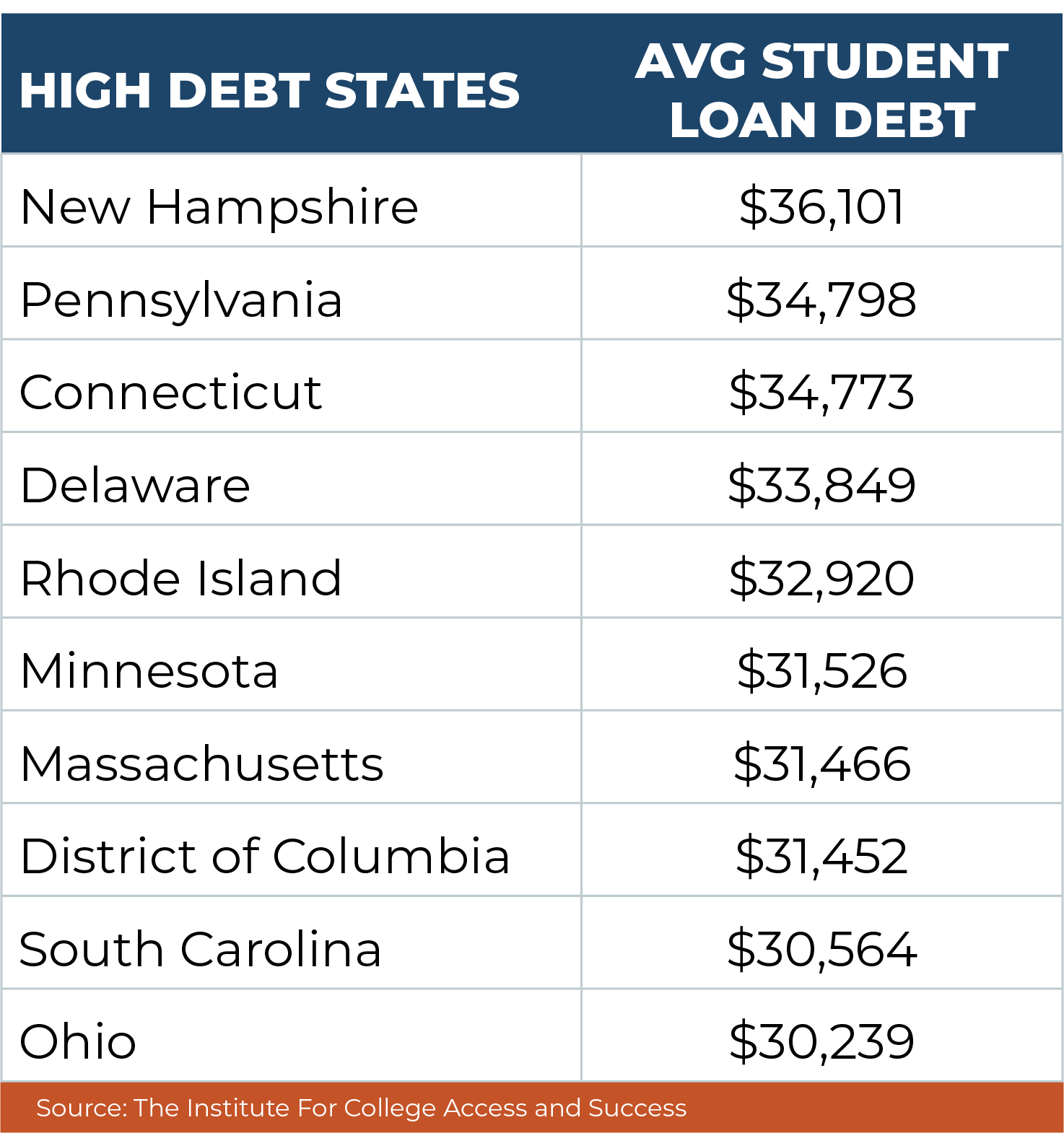

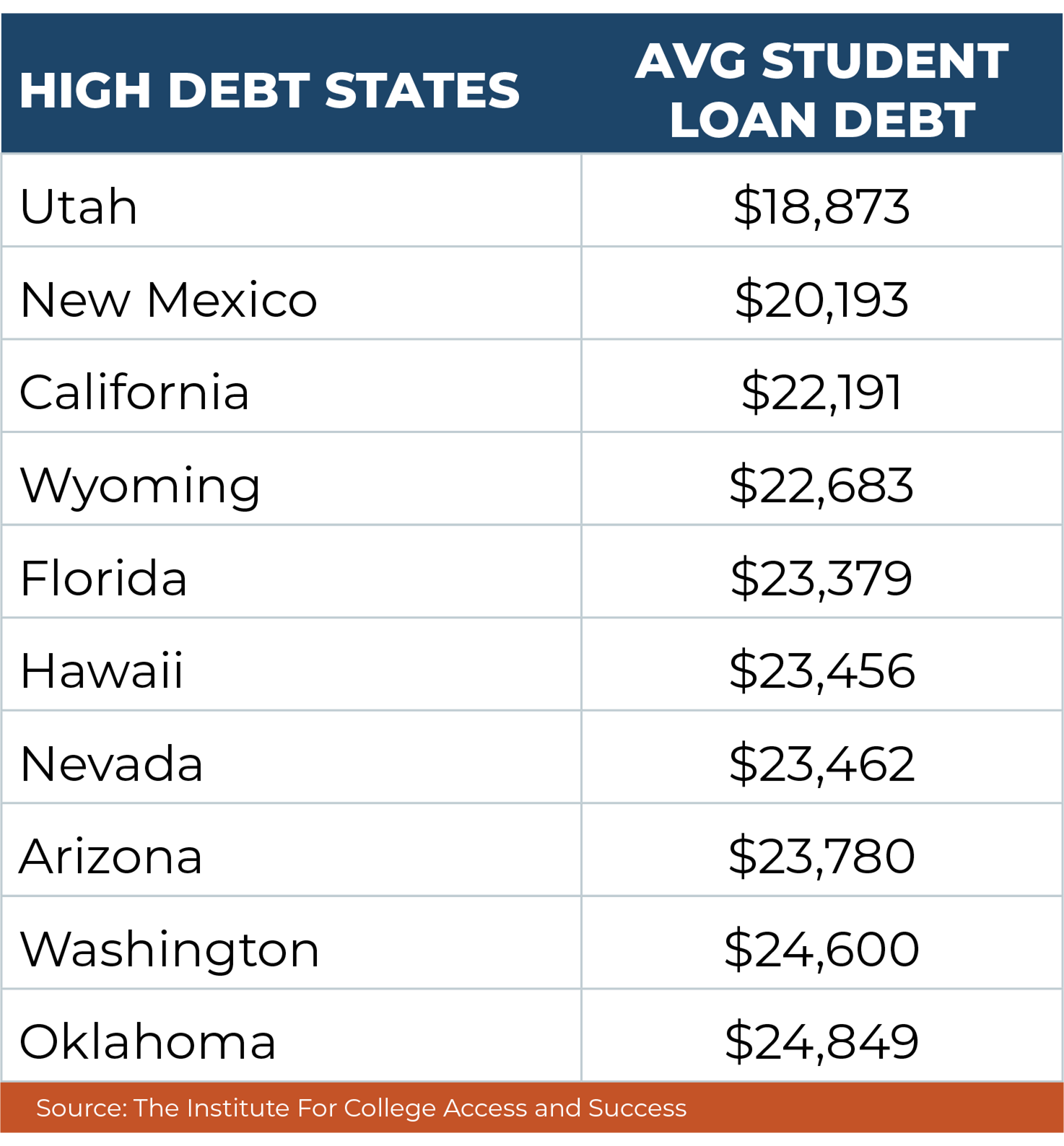

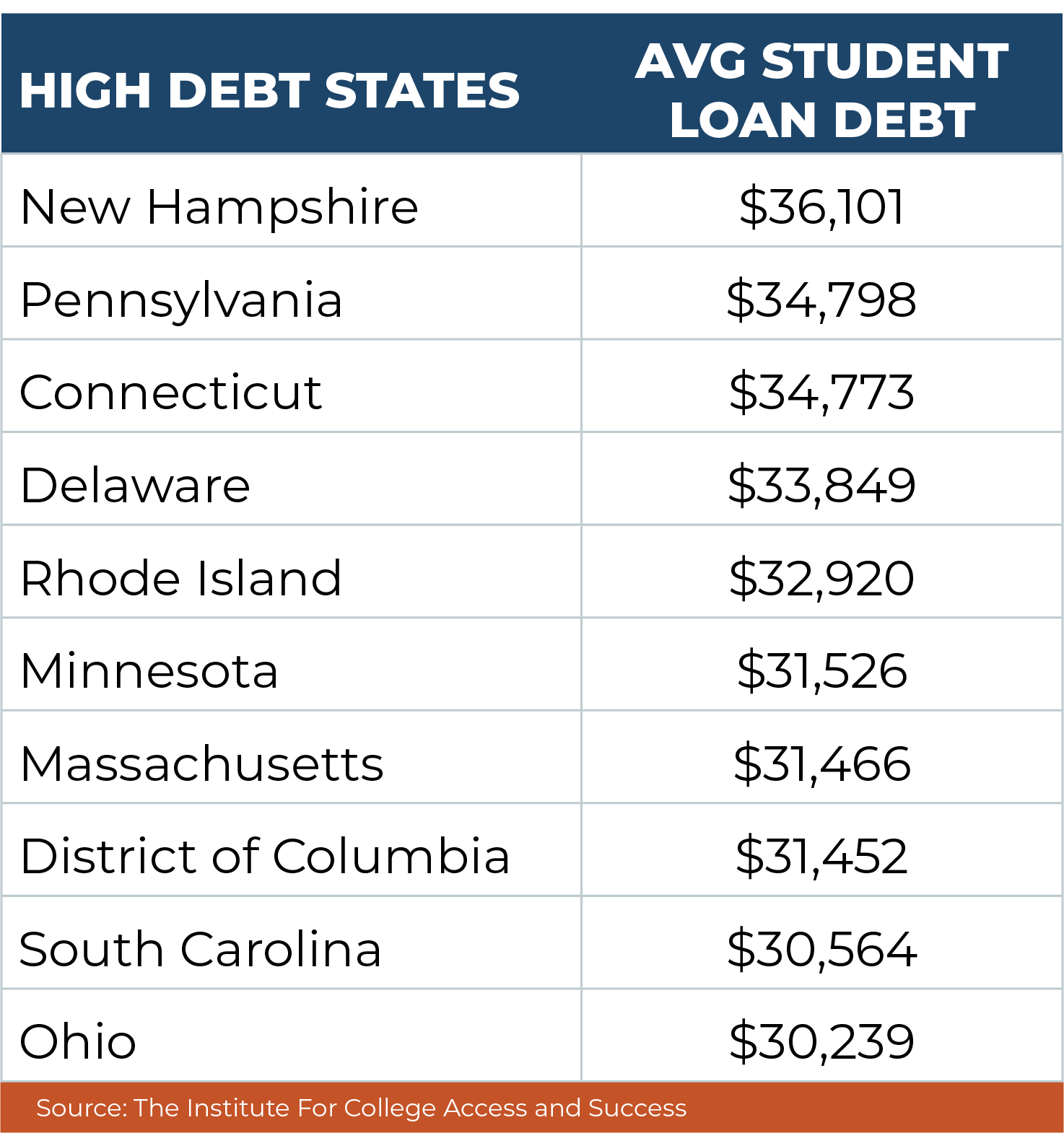

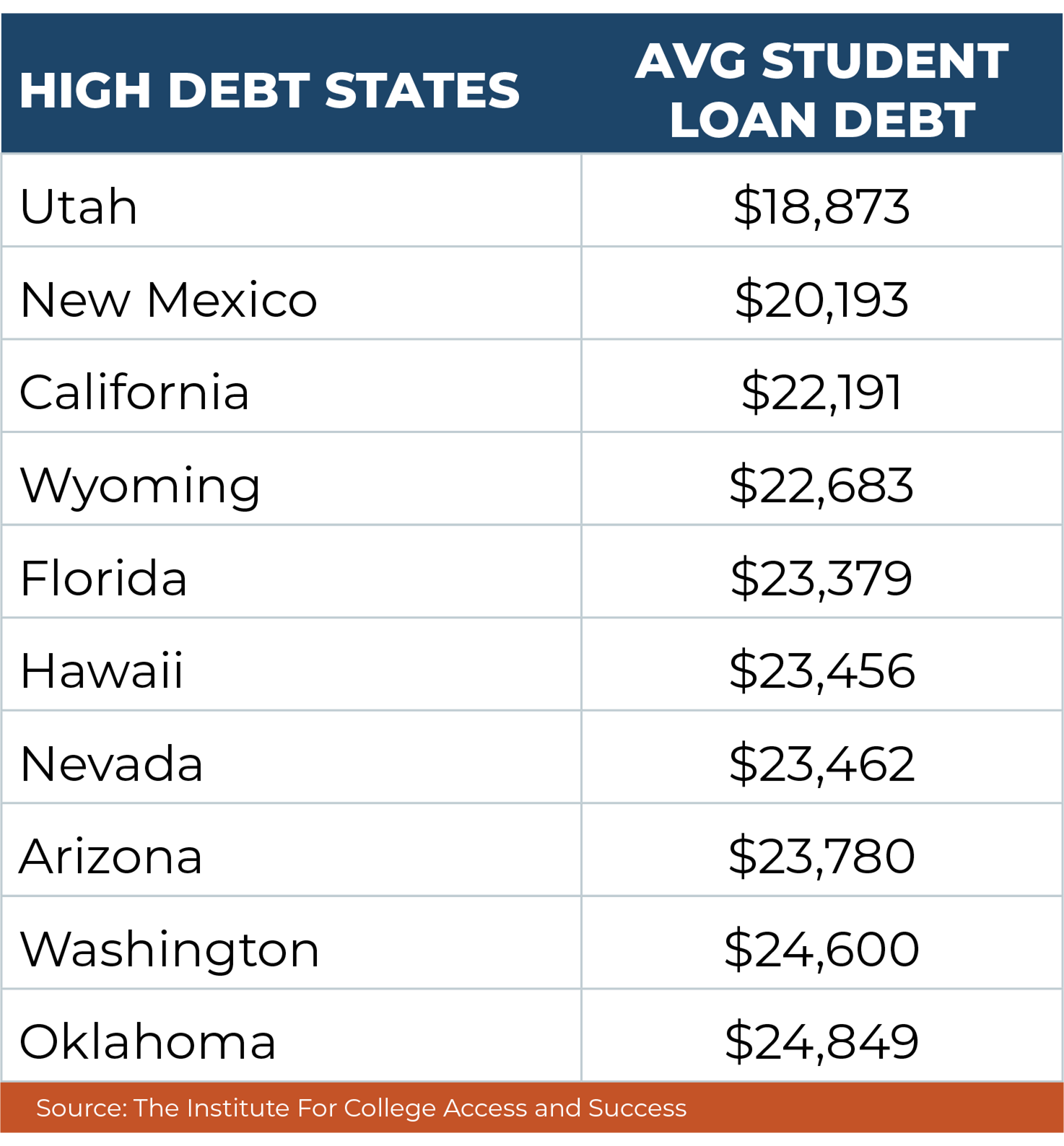

You do not want to be included in these last three statistics! Please see some average student debts by states below:

Here’s what you need to know to protect yourself from this financially devastating epidemic in our nation. You need to obtain student loan protection in the event of a disability. This protection will act as a safeguard so you will be able to always meet your student loan payments.

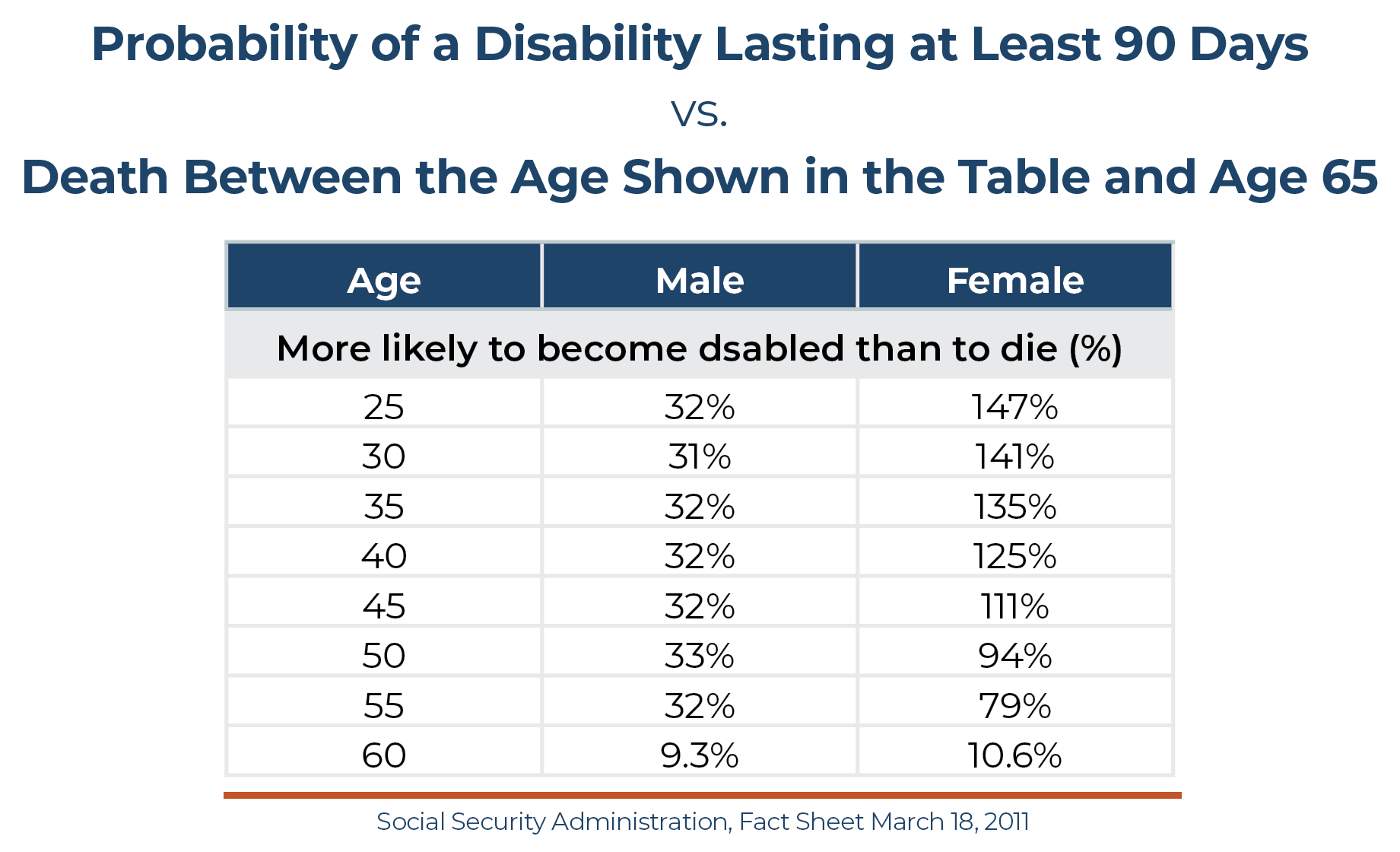

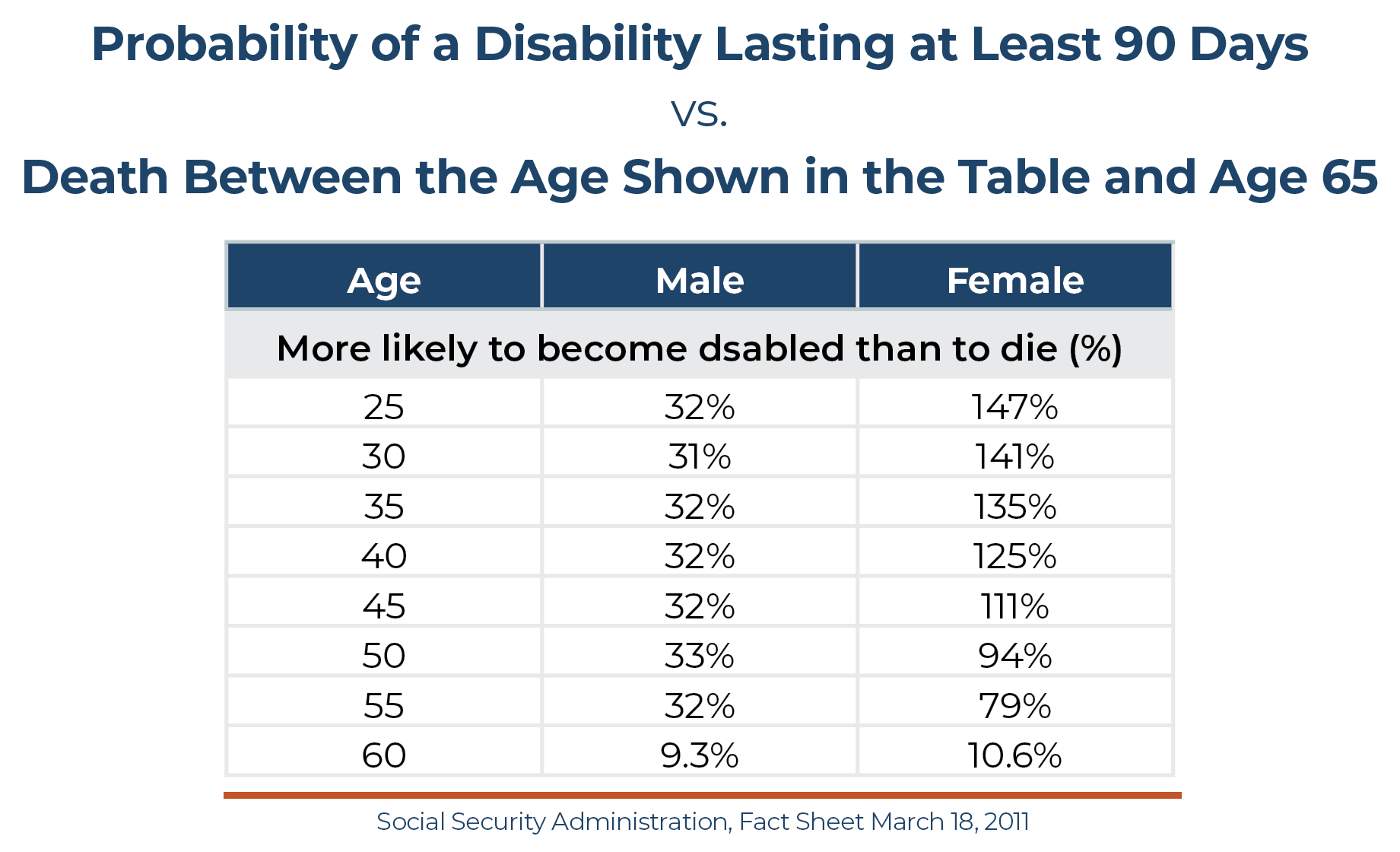

Disability Insurance offers you financial protection from the myriad of things that could hinder your ability to earn a living. Most people think that disability does not happen to younger people and that most disabilities are due to work-related accidents. In actuality, the odds of having a long-term disability (one that lasts 90 days or longer) before age 65 are significant.

- Just over 1 in 4 of today’s 20-year-olds will become disabled before they retire.5

- Approximately 90% of disabilities are caused by illnesses rather than accidents.6

- The average disability claim lasts 31.6 months.7

- One in eight workers will be disabled for 5 years or more during their working careers.8

You are most vulnerable early in your career. As you begin your professional career, your income is just beginning to grow, and your unpaid student loan debt is at its highest level. You are very vulnerable if you become disabled at this point.

You are most vulnerable early in your career. As you begin your professional career, your income is just beginning to grow, and your unpaid student loan debt is at its highest level. You are very vulnerable if you become disabled at this point.

Guardian’s Provider Choice policy (Premier and Select) offers an optional Student Loan Protection Rider that will allow you to:

- Obtain additional coverage (up to $2,000/month) above what you may otherwise qualify for based on your income1

- Tailor coverage to your specific debt to reimburse $250-$2,000 per month toward student loan payments2

- Choose a rider duration of 10 or 15 years4

1 MakeLemonade.com

2 As of 4Q 2016, New York Federal Reserve

3 Reimburses $250-$1,000 per month toward student loan debt incurred from a degree-granting institution; $250-$2,000 if pursuing or holding an advanced degree (i.e. degree beyond undergraduate).

4 This rider provides coverage for a period of 10 or 15 years from the policy date. When a qualifying total disability occurs, benefits are only payable during the remaining portion of the 10- or 15- year term that has not elapsed when the disability begins.

5 U.S. Social Security Administration, Fact Sheet February 4, 2013.

6 Council for Disability Awareness, Long-Term Disability Claims Review, 2012.

7 Gen Re, U.S. Individual DI Risk Management Survey 2011, based on claims closed in 2010.

8 Commissioner’s Disability Insurance Tables A and C, assuming equal weights by gender and occupation class.

Individual disability insurance policy Forms 18ID, 18UD and 18GI underwritten and issued by Berkshire Life Insurance Company of America, Pittsfield, MA, a wholly-owned stock subsidiary of The Guardian Life Insurance Company of America, New York, NY. Product provisions and availability may vary by state. In New York: These policies provide disability insurance only. They do not provide basic hospital, basic medical, or major medical insurance as defined by the New York State Insurance Department. For policy form 18ID, the expected benefit ratio is 50%. For policy forms 18UD, 18GI, 18UD-F, an 18GI-F, the expected benefit ratio is 60%. The expected benefit ratio is the portion of future premiums that the company expects to return as benefits when averaged over all people with these policy forms.

This material contains the current opinions of the author but not necessarily those of Guardian or its subsidiaries and such opinions are subject to change without notice.

Disability Insurance Benefits Should Not Go To Paying Back Student Loans

Disability Insurance Benefits Should Not Go To Paying Back Student Loans

You are most vulnerable early in your career. As you begin your professional career, your income is just beginning to grow, and your unpaid student loan debt is at its highest level. You are very vulnerable if you become disabled at this point.

You are most vulnerable early in your career. As you begin your professional career, your income is just beginning to grow, and your unpaid student loan debt is at its highest level. You are very vulnerable if you become disabled at this point.